Advantages of Investing in Farmland

- Increasing global demand for food

- Consistent long-term appreciation

- Annual cash return

- Non-volatile asset

- Store of value

Investor-Friendly Country

- Foreign and local investors treated equally

- No limitations to ownership by foreign buyers

- No currency exchange controls or forced conversion

- Foreign currency can be used: Dollars, Euros, etc.

- No restrictions or taxes when transferring money into, or out of the country (repatriation of capital)

Stability and Safety

- Latin America’s safest country

- Tops rankings in political and economic stability

- Tops rankings in transparency and lack of corruption

- No social turmoil: existence of middle class and Latin America’s lowest income gap

- Solid legal system with strong reputation for respect of contracts and private property

Why Farmland in Uruguay?

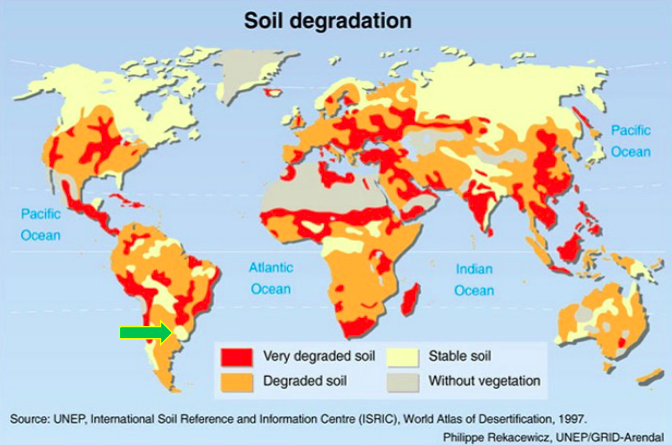

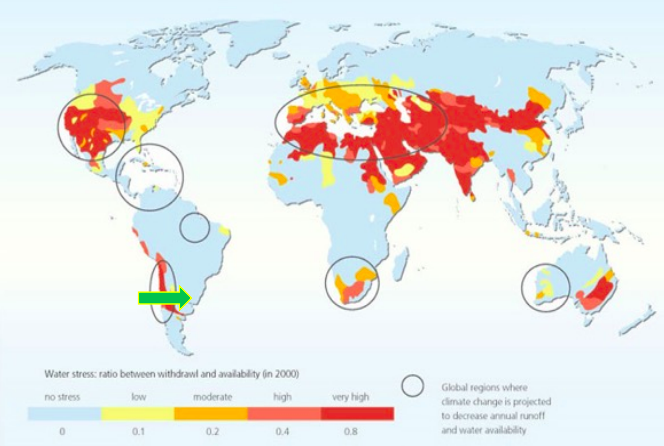

Advantage # 1: Uruguay’s Suitability

- Non-degraded soil

- Even rainfall year-round

- World’s largest aquifer beneath region

- Temperate climate

- Two crops per year (over long run: 1.7)

- Competitive producer

- No government intervention in the market

- Developed land rental market

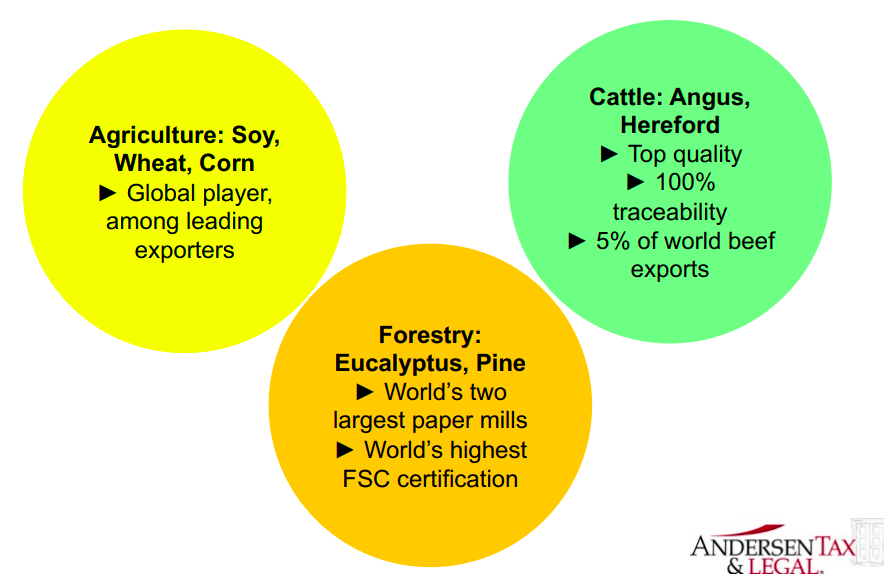

Uruguay: A Global Player

- 6th exporter of soybeans

- 5th exporter of dairy products

- 4th exporter of rice

- 5% of global beef exports ... Plus, Uruguay is the only country in the world with 100% traceability of its herd

A country of 3 million feeding 40 million people

Plus: One of the World’s Best Places for Forestry

- Fastest growth rate of eucalyptus, due to soil, climate and water availability: 8-10 year cycles

- World’s highest FSC certification: 85% of forests

- In 2006 UPM (Finland) and in 2010 Stora Enso (Sweden) built the world’s largest and newest pulp mills ....and in 2019 UPM launched a new one:

Global soil degradation, and where Uruguay stands

Escasez de agua a nivel global y la posición de Uruguay

Advantage # 2: Turnkey, Easy Investment

Most investors choose to:

- Outsource management of the operation to a farm management firm, which handles all aspects of the business (expertise is widespread and available); or

- Lease out the land (there is a very liquid rental market available).

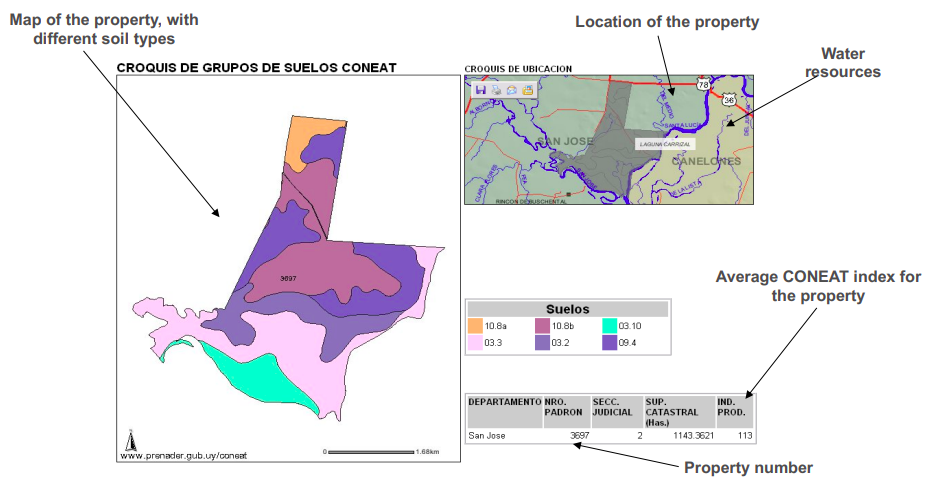

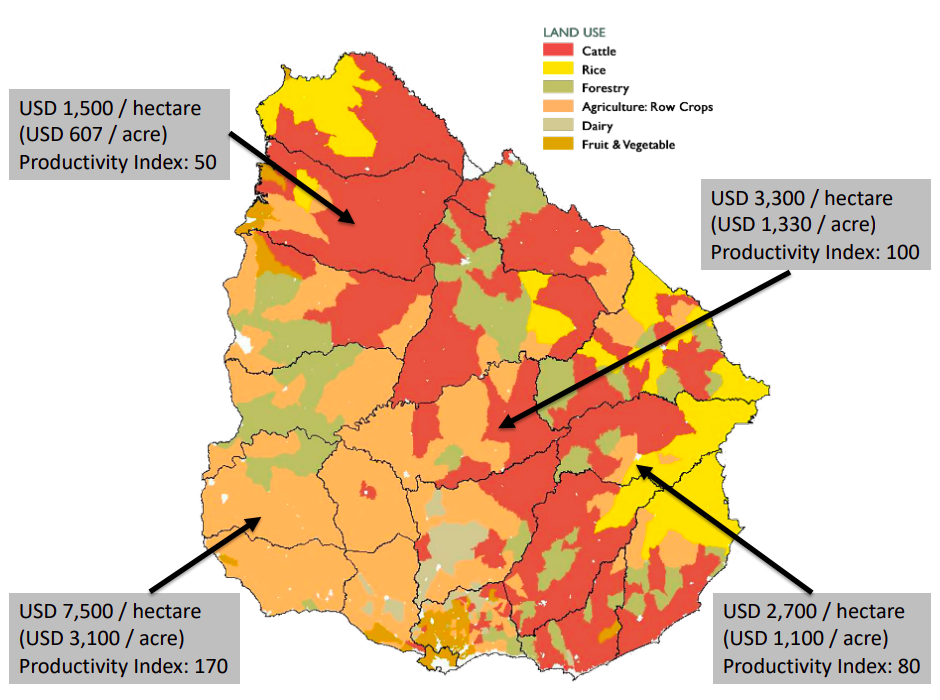

Advantage # 3: Transparent Market for Land

- The country is mapped, with soil types classified according to their productivity

- Each type of soil is has a productivity index (“CONEAT” index)

- The map is available online

- Thus, land productivity is verifiable

The Online “CONEAT” Productivity Index

- Type here

- Plug in the property number(s)

- The system will show the specific property’s:

- location and water resources (rivers, creeks, lakes)

- detailed soil map, with soil types in different colors, and the percentage of each soil type

- description of each soil type

- the productivity index of each soil type (“CONEAT” index)

- the average “CONEAT” index for the whole property

The Online CONEAT System: Example

Advantages of the CONEAT System

- It allows anyone to verify the productivity potential of a property in Uruguay

- It provides a tool to determine uses for a specific farm

- The CONEAT index of a property correlates with the price of the land. The market is thus very transparent: it is easy to compare properties and determine their fair value

Types of Land in Uruguay

- Agriculture (soybeans, wheat, rice, etc.)

- Cattle/sheep ranches, dairy farms

- Forestry: eucalyptus, pine

- Vineyards / olives / blueberries

- Oceanside rural land for development

Uruguay’s Most Attractive Options

The Price of Land

Farming has favorable tax treatment in Uruguay:

Income tax:

- Flat 25% income tax rate, levied on net income

- For small farms, the rate is lower: farms with gross income below USD 250,000 per year have a capped tax amount of USD 5,125 (IMEBA system, which taxes sales –at 0 to 2%- instead of net income).

- Certain timber operations qualify for tax breaks

Low property taxes: average is 0.2% *

Our Services

We are a full-service Law and Tax Firm, with a specialized division assisting overseas farmland investors, both institutional and individual.

Our Farmland investment advisory unit assists with:

- Sourcing farmland according to client needs/preferences

- Structuring purchases

- Organizing corporate structures, setting up ongoing farm management

Our Legal and Tax Services include:

- Conveyance / Legal Assistance in the Purchase Process

- Tax and Accounting Support

- International Taxation

- Company Incorporation

- Legal Services in general (contractual, corporate, labor).

Andersen is the Uruguayan member firm of Andersen Global®, an international association of member firms comprised of tax and legal professionals worldwide.